I admit I’m a bit checked out for the holiday break.

I have a lot of ideas for newsletter topics, but it’s early, I’m enjoying my morning coffee, and I don’t feel like thinking too hard right now.

So this morning, I’m giving you a breakdown of my investments. Hopefully, this will set the tone for the new year and help you create a philosophy of your own.

LFG. 🔥

Investing Is Boring

Years ago, I read I Will Teach You To Be Rich by Ramit Sethi. This book changed my life more than any other investing book.

It taught me the architecture behind investing. Growing up, I didn’t even know what investing was, but this book explained it in simple terms. Ramit showed that investing should be automatic. The more you think about it, the worse you’ll do.

So I built a system that handles everything for me. It’s completely automated, freeing me to focus on growing my companies and generating more cash flow to make additional investments.

Here’s how it works.

The Three Categories of Investing

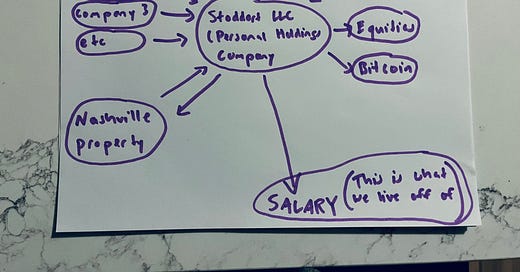

I think of my investments in three main categories:

Private investments

Equities

Real estate

These categories work together to create automation. Let’s break it down.

It All Starts With Client Services

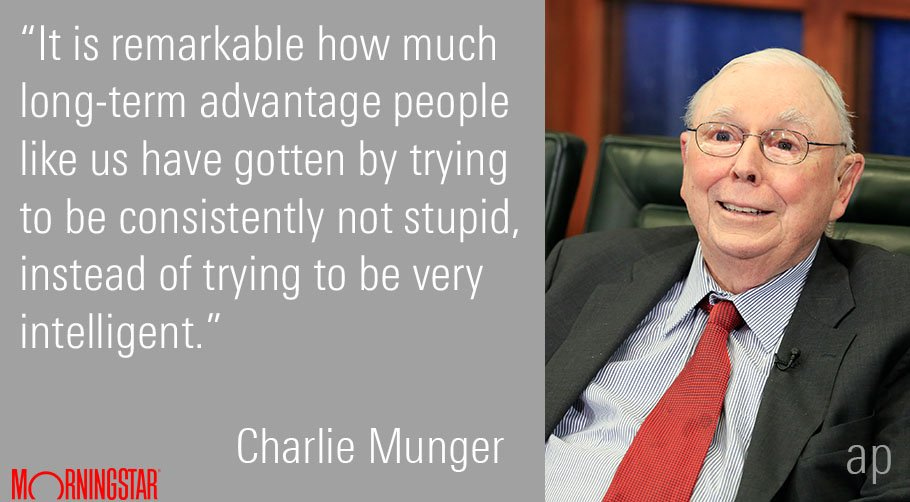

Longtime readers know I’m a huge advocate for creating a client services business. While client work isn’t as flashy as building a billion-dollar tech startup, it has one key advantage: cash flow.

Every investment I’ve made started with cash generated by my agencies.

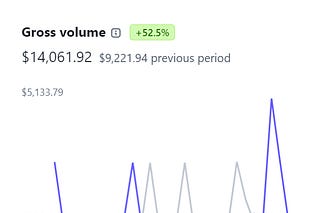

Currently, The Shop AI is producing the cash and profits that fund my investments. As shown in the visual I use, this is represented by the “Client Services” bubble at the top. The Shop funnels money into Stoddart LLC, where it builds up into a war chest. If I don’t find anything worth investing in, the money sits in a high-yield interest account earning 4%. It’s not much, but it quiets the voice in my head saying I need to do something with it.

This setup ensures The Shop generates cash that flows into Stoddart LLC. From there, the money either goes into investments or waits until an opportunity arises.

My Private Investments

All my private investments are owned by Stoddart LLC, my personal holding company. Any deal I make ensures my company is the legal owner of the equity.

This setup mirrors the process with The Shop. Every month (or quarter, depending on the distribution schedule set by the CEO), money from these investments flows back into Stoddart LLC as dividend payments.

These investments include:

Copyblogger

Hey Creator

Boomtown

And more

You can check out my portfolio for the full list.

The funds used for these investments come from the war chest in Stoddart LLC, which grows through dividends and profits from The Shop. I’ve never borrowed money or leveraged debt outside of mortgages. Every private investment I’ve made comes from cash I saved or companies I started and handed off to operators.

Real Estate

The same principles apply to my real estate investments.

Each month, I pay the mortgage on my rental property through my company, and the rent payments are deposited into Stoddart LLC.

I don’t see myself as a real estate investor in the traditional sense. My goal is to build a portfolio of rental properties over the next 30 years, creating a collection of hard assets I can leverage or sell as property values rise.

Currently, we’re paying the mortgage on our home. Eventually, we’ll move and convert it into a rental property. The details of my current real estate investment are here.

Equities

Every week, I automatically invest in the stock market and buy Bitcoin.

I never look at my stocks, try to time the market, or stress about fluctuations. I believe in Warren Buffett’s philosophy of dollar-cost averaging.

Here’s the breakdown of my weekly investments:

$500 into the S&P 500

$250 into the Vanguard Real Estate Index

$250 into Bitcoin

In my opinion, investing in the American Stock Exchange is the simplest way to build wealth. There are days I think all my hustling might be unnecessary. If I were more patient and less restless, I’d advise most people to just automate their investments into index funds and call it a day.

The downside to equities is the time it takes. Private investments yield faster returns, but the losses from those investments might have been avoided if I had just invested in the stock market instead. I haven’t done the math and never will, but I’m happy with the game I’ve chosen to play.

For now, $1,000 a week into index funds and crypto works for me. I’ll increase that amount soon.

My Salary

Jules and I live off my salary.

I take a salary because it reduces the tax burden and creates a psychological divide between our family budget and my investment funds.

We live on about $140,000 a year, which allows us to focus on what matters most to us. Most of our spending goes toward food because eating organic is a priority. We also invest in health and wellness, including gym memberships and supplements.

We rarely eat out, but we enjoy date nights at fancy restaurants and concerts when we can. Now that the kids are older, it’s easier to get a babysitter and enjoy some time together.

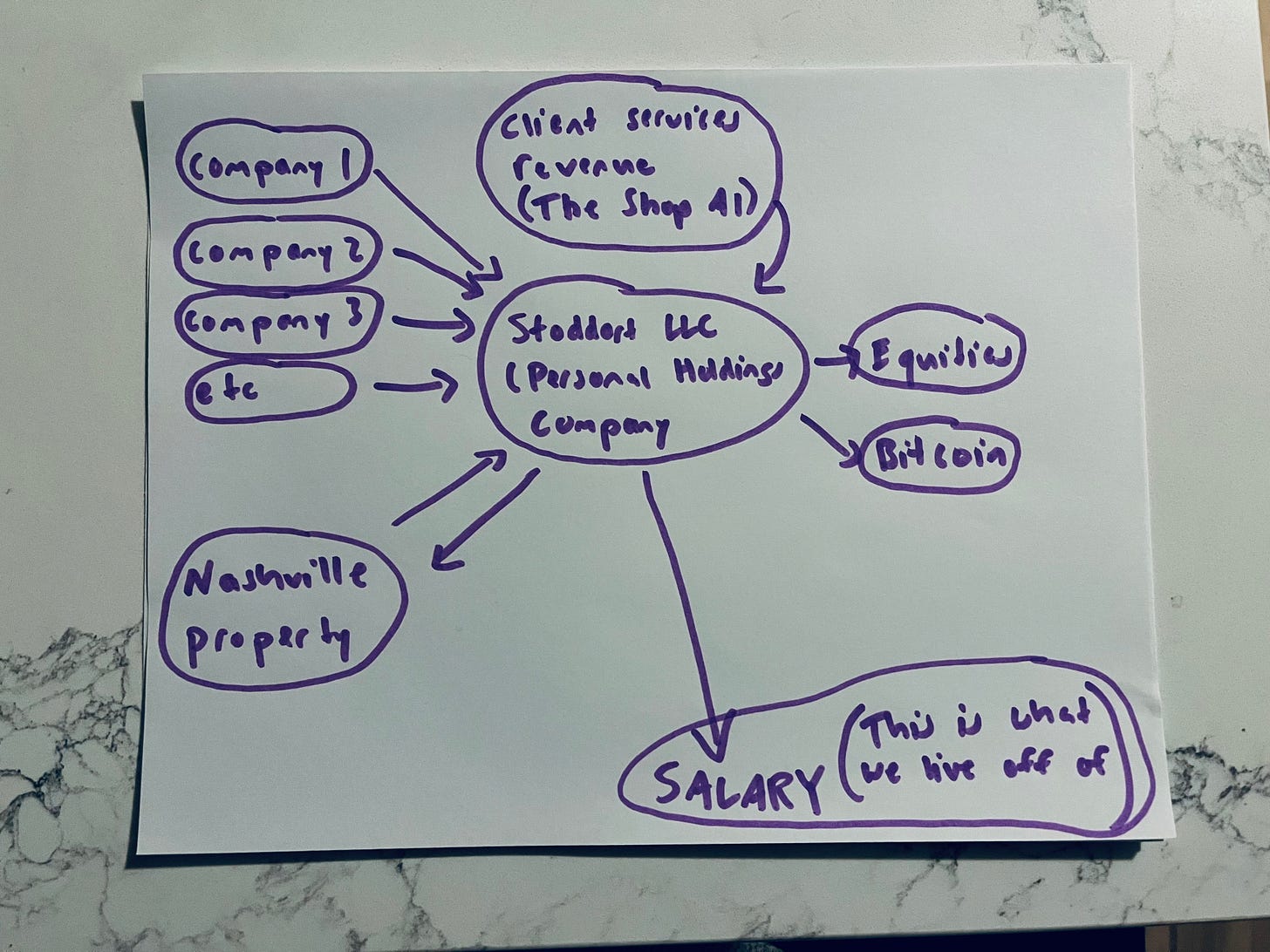

Successful Investing Means Not Messing It Up

One of my heroes, Charlie Munger, has a quote I live by:

"My investing philosophy is about not being an idiot."

Most people, including me, lose money when they think they’re smarter than they are.

Investing is about riding waves. In the long run, economies grow. My philosophy is to align with smart people in growing industries and let capital do the hard work.

The less I do, the more money I make.

I hope this inspires you to think about your own approach to investing.

Merry Christmas to those who celebrate.

Love you guys.

Tim

Learn How To Create Multiple Streams Of Income

Join the TimStodz Incubator.

As a member, you'll get access to:

A vibrant community of like-minded entrepreneurs and creators.

One-on-one access to me for personalized guidance.

Exclusive courses on topics like building directories, getting clients, and scaling income streams.

Behind-the-scenes insights into my business journey, including how I’m building my portfolio to $10M a year.

VIP access to live lessons, tools, and strategies I’ve used to create real results.

All of this is hosted on Substack, keeping everything simple, streamlined, and effective.

Start building your future today. Click here to join the Incubator before the price goes up!

Surprised at your (fairly) low personal salary. I thought you menntioned a higher number in another post