The Cashflow On A Condo In The Philippines I'm Thinking Of Buying

I don't know if I'll do it yet, but I am writing it all out because it helps me think.

I’m very interested in Southeast Asia. I’ve written extensively about the region, and the data tells me that SE Asia will be where the next economic boom takes place.

More specifically, I’m interested in …

Vietnam

Singapore

Thailand

The Philippines

I have a team in The Philippines who I have worked with for years, so I’ve learned more about that country than others, simply because I have better first had access.

Through these team members, I was able to come across an interesting real estate opportunity that I will share with you today.

LFG. 🔥

The Property

This is a very small condo located in a condominium tower in Quezon City.

The Tower is called M Place.

In The Philippines, real estate works a little different. The “developer” (or the builder) still owns the percentage of the condo that the buyer hasn’t yet paid off. So if I were to buy the condo, I would be buying from the developer AND from the owner in relation to their equity.

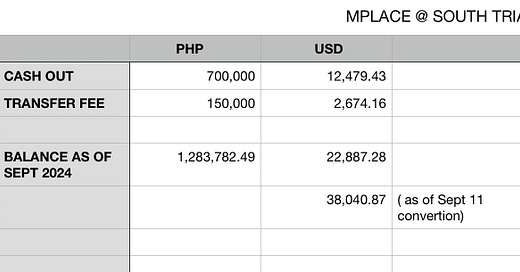

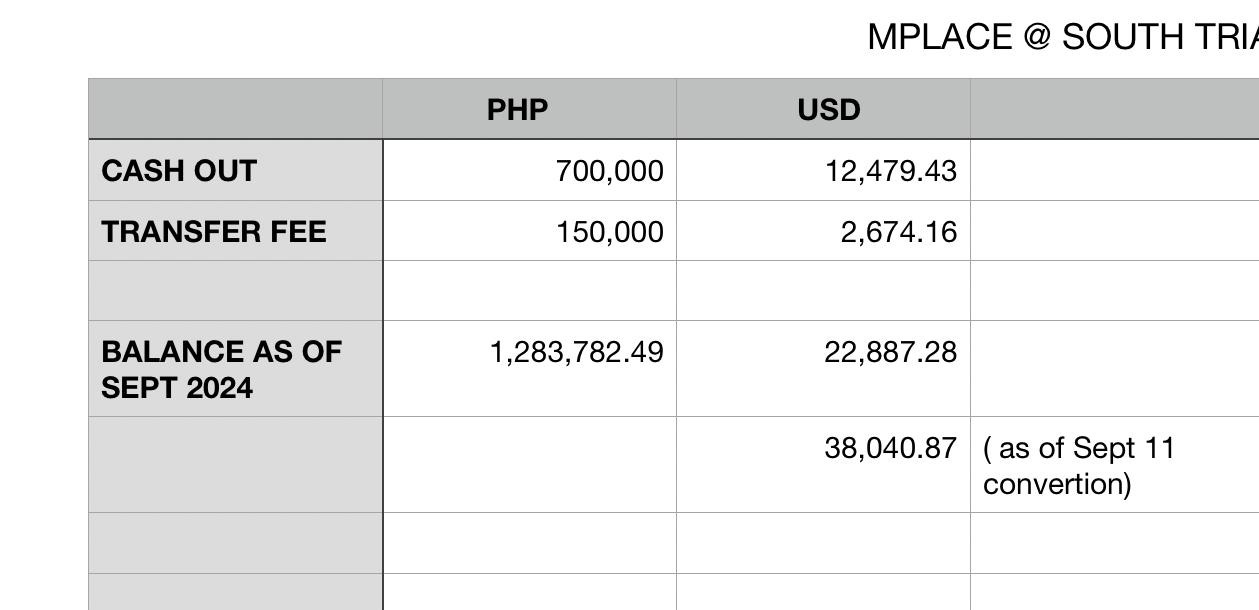

In short, I can buy the condo for $38,040.20.

If I were to take advantage of this opportunity, $22,887.28 would go to the developer and the remaining balance goes to the current owner.

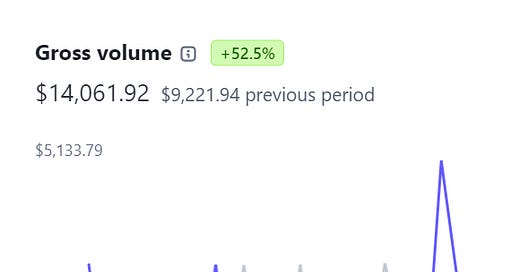

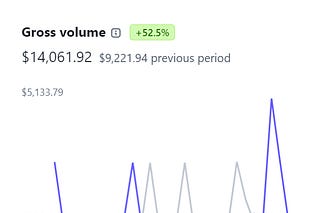

The Income

As I said, it’s a very small condo. It’s not uncommon for young people to rent these sorts of condos in Quezon City, because many of them ride their bikes or scooters to their places of employment.

Think of it like an NYC studio apartment.

There is currently a tenant in the condo. Her lease would be in up January, but it’s likely the will resign. If she does, and I keep everything as is (which I would) then the monthly cash flow is ₱15,000 per month.

I would owe ₱1,700 in monthly association dues. As such my net monthly income would be ₱ 13,300 or $234.56.

Why The Philippines?

I’ve written a lot about why I’m so interested in Southeast Asia. If you want to learn all the details, please read the article below.

But the main reason for this is because the demographics for The Philippines is very healthy. There is a lot of young people in the country, and the world is funneling a lot of digital industry to The Philippines, which means cities like Quezon City are going to be hot beds to new business.

In short, young people need jobs and apartments.

Why This Condo?

I’m not a real estate mogul. My plan with real estate is simply to buy the houses that we live in, and then eventually rent them out as we continue to live in different places and travel.

However, I’m becoming more and more interested in real estate and rental properties as a means to generate revenue. There are two reasons for this …

I’ve had a great experience with my house in Nashville and it’s opened my eyes to the value of real estate as an asset class.

Over time, I would like to transition some of my capital away from the volatility of digital businesses and over to something more boring and stable like real estate.

The Philippines are an emerging market. Although it’s a well established country, the economy is starting to take advantage of the movement of western capital away from China.

I see this is a semi low risk way to learn about the real estate market in The Philippines. Who knows? If I decide to do it, and if it goes well, I could build an entire portfolio in the county.

It could be a fun adventure.

Want To Work With Me? Here Are 3 Ways I Can Help You

1. Learn how to create multiple streams of income: You’ll get V.I.P. access to my business, research, and analysis. My membership will teach you how to create multiple streams of income. (Price goes up on 9/1)

2. Join my coaching program: I’ll help you grow your business by helping you define your target customer, create compelling products and services, generate more sales, and create systems that do the hard work for you. For serious entrepreneurs only.

3. Want me to do your marketing for you? Fill out this form to see if you’re a good fit for my high level SEO / advertising service. Minimum cost is $5000 a month.

I also have a rental house in Nashville. It's a 3BDR townhouse and I used to live in it as well. One question for you--have you thought about buying other property in Nashville?

Would there be some economies of scale, like using the same prop manager for multiple properties nearby that you wouldn't get with your properties being scattered in different parts of the country/world?

Love this! We're also developing a condo in Cebu, Philippines that'll be RFO this December.

Your positive outlook is encouraging