Why You Should Never Lose Money (and How I Lost $12,000 in 10 Seconds)

There is a principle of entrepreneurship and investing that I like to keep top of mind.

Ready?

Here goes...

Rule #1: Never lose money.

Rule #2: Never forget rule number 1.

- Warren Buffet (I think...)

You will gain a huge advantage by never going backwards and never losing ground. The reason why this rule is so important is mathematical. There's a formula for financial success.

In case you're interested, here's the formula.

Compounding is the 8th Wonder of the World

When you lose money, you obviously lose the money you have right now.

What's worse is you lose the upside that the money can make for you in the future. Losing a dollar is much more than losing a dollar. What you lose is the work that the dollar could generate, and then you lose the work that those dollars that were generated can also generate.

Albert Einstein is famous for saying that "compound interest is the 8th wonder of the world." He's right in his assessment.

With compound interest at your side, financial success is actually a very simple equation. Small deposits of money into an S&P 500 index fund can generate huge returns over a long enough timeline.

The reason most people never see this success is because we are evolutionarily programmed to look for the BIG WINS that generate instant gratification. Most Americans could get rich by taking the money they spend on fast food and lottery tickets and investing that money into the market.

It really is that simple.

Consistent investing never FEELS like it's working, but that's only because you haven't given your money enough time to grow. Compounding always grows slowly and then all at once. But without the consistent investments over time, you never get to see that parabolic growth.

It doesn't matter if you're investing into the market or investing into a business you're building, compounding interest is where all the returns are generated.

It usually looks something like this.

I Repeat, Never Lose Money

By simply not losing money, you put yourself in an extremely advantageous position. This is why the entrepreneurs and investors with the best track records are always the people who are frugal and tight with their spending.

It's not that successful entrepreneurs don't spend money, it's that they don't lose money.

Got it?

That mindset has been one of the biggest reasons for my entrepreneurial success so far. It's something I'm very proud of. I try to hold myself to a standard.

Always put money to work.

Don't mess around with day trading or trying to time the markets.

Don't go after quick wins.

Let compounding and time do the hard work for me.

Make disciplined decisions that delay gratification.

That's why what I'm about to tell you hurts do damn bad.

Here goes...

How I Mis-Clicked a Loss of $12,000+

Last week, I published an article about how I made $7000 flipping NFTs.

I've completely immersed myself in the world of Web 3. I've been making new friends on Twitter, learning a lot, and making money. It's been great.

After the success of my first NFT flip, I went big and bought an NFT that had a lot of demand and was very expensive. I bought a Mutant Ape. I was very excited about it. I loved looking at it and I felt like I was "part of the club."

After buying the Ape, I immediately got offers for it. One of the offers would have netted me $4000. I decided to hold out. Finally, the offers stopped coming in and I decided to take advantage of the most recent offer.

I was going to do another quick flip and walk away with $1000.

This is where I fucked up...

Conventional wisdom says to hold onto my Ape NFT. My better judgement told me that I should hold onto it for years. 5 years from now, it could be worth millions. Mutant Apes are some of the most popular NFT pieces on the market.

All I had to do was nothing at all.

But I was feeling cocky and confident and proud of myself for making another quick win. I decided to pull the trigger. I was going to sell my ape.

So I accepted the offer. After fees, I would have made $987.34.

You won't believe what happened next.

I clicked on the wrong button.

Someone sent in a lowball offer of .45 ETH. I don't even know how it happened. Somehow I clicked that offer and didn't realize it. I didn't even know I made the mistake until I checked the etherscan and read the sale price in the hash.

I couldn't believe it.

Shortly after, I got the email notification congratulating me on my sale.

My fears were correct. I clicked the wrong button and instead of making $1000, I lost $12,000.

Fuck.

I Feel Like a Big Stupid Dumb Head

Losing the money sucks. $12,000 is a lot of money. I get upset when I lose $5, so I'm obviously annoyed at myself.

But what is really making me feel terrible is that I lost the money by acting in a way that goes against my beliefs as an entrepreneur. I tried to play the hot shot day trader and in doing so, I cost my wife, my son, and myself opportunity in the future upside.

As soon as I realized what happened, the first thought that popped into my head was "my wife and son trust me."

I really feel like I let them down.

The worst part of all is that I was trying hard to be responsible. I was watching the NFT markets, I was paying attention to the floor prices, I was making what I thought to be "sound investments."

But it doesn't matter, because the end result is that I made a simple mistake that costs me 12 grand. That would never have happened if I would have stayed focused on my true calling and stayed discipline in my process.

I feel like an idiot. I feel embarrassed and for a few days, I was walking around with that nagging guilt feeling that feels like you have a knot in your stomach.

Lesson learned.

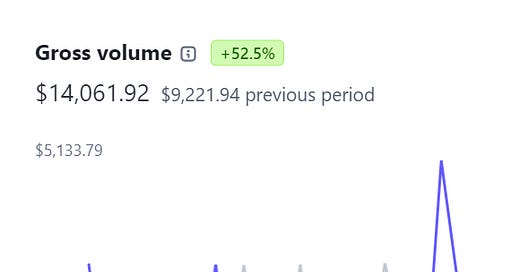

More Reason to Obsess Over Cash Flow

I do not throw around $12,000 like it's irrelevant, but the truth is that it's not going to affect my life much.

If anything, it's given me an clearer picture of what is important.

Monthly cash flow is the name of the game. That is the game I play best and the game I believe you should play as well.

Nothing will ever take the place of getting rich slowly. Compound interest will be the biggest tool of your success.

I want you to learn from my mistake so you don't have to make the mistake for yourself.

To goal of entrepreneurship to build businesses that generate revenues that equate to profits at an asymmetric rate.

Day trading is not a business model. It's an addiction that is systematically designed to funnel money from 90% of the traders and funnel it to the top 10% of holders.

Do yourself a favor. Stay focused on building a business that generates long term success and happiness. Follow the formula to long term wealth.

What About NFTs?

As I said, I'm excited about the future of NFTs. I'm excited about blockchain.

As far as my own interest in participating in the NFT market, I plan on taking a giant step back.

I still have some valuable NFTs in my wallet and my hope is that over the course of the next few weeks, months, and years, my NFTs will increase in value and I'll make my money back and even pull a small profit. I'll continue to play around in the market, but I'll never do something so stupid like that again.

I am back to being laser focused on what matters.

I'm back to focusing on profitable cash flow.

I'll stick to what matter's most. I'll stick to what I'm good at.