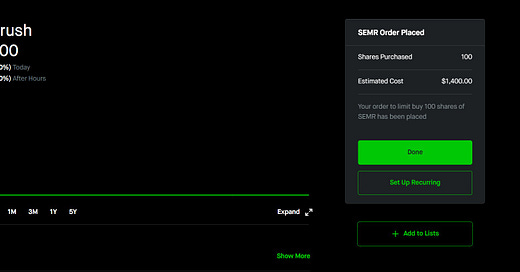

Why I Bought 100 Shares of SEMRush

SEMRush is an online software product that helps online marketers track keywords, research online marketing opportunities, and more. In total, their software product offers dozens of tools to help people grow businesses through online marketing.

I have a strict investment policy of “I only buy stocks that I am willing to hold for 10 years.”

Most of you know how I feel about day trading. If you don’t, let me remind you that day trading is stupid and the absolute best way to lose money. So my long term investing thesis informs all my investing decisions.

However, I will admit that this purchase did have some emotion behind it. I think this investment is half rationale, and half emotional. Let me explain.

Emotional

SEMRush has helped me build every one of my companies. I have grown the vast majority of my websites through inbound search traffic, and SEMRush is the tool I use to do this.

There are other tools as well, such as ahrefs. But SEMRush has been, by far, the tool I have relied upon most.

I couldn’t have done it without them. It has helped me so much. In a lot of ways, SEMRush has been the #1 contributor to my SEO success in the last 10 years.

If going public is a means for companies to raise capital, I am happy to support the company in the small way I can. I feel I owe it to them.

Rational

As I said, I only buy stocks that I am willing to hold for 10 years.

Before I buy a stock, I ask myself “where will this company be 10 years from now?”

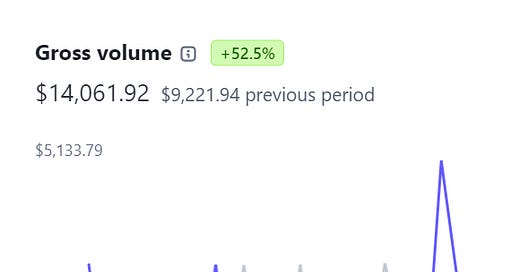

Logic tells me that online marketing will be a bigger industry 10 years from now than it is today. I have very strong beliefs in the concept of individuals building online revenue streams for themselves.

So I ask myself, will more people, or less people, be using software products to help them grow their online brands?

I think the answer is more, and that’s why I bought the stock.

Congrats to the team at SEMRush.

P.S. - I’m not an investor and this is not investment advice and you should never make investment decisions based on my blog articles. Invest at your own risk.