You've Been Lied To About Asset Allocation

The definition of an asset is not what you've been told. Here's why knowing the true definition will change your life.

In the western world, (and especially in America) we are taught that home ownership is an important step to creating wealth. We are told that “your house is your most valuable asset.”

When you look at a your personal balance sheet, you list your house as an asset. Strangely enough, you can also list your car, your jewelry, your Gucci purse, and even your wedding ring.

The reason our financial institutions consider these objects to be assets is because they want you can leverage your “assets” and borrow against them. The bank will hold your assets as collateral in case you aren’t able to pay back the loan.

However, the entire structure is built around boring, debt, and credit. In reality, I consider these investments to be liabilities.

In this article, I will teach you the true definition of an asset.

Robert Kiyosaki: The True Definition Of An Asset

In case you’ve never heard of him, Robert Kiyosaki is the author of Rich Dad, Poor Dad. It’s a classic finance book that stands the test of time. Although Kiyosaki is a bit of a deranged lunatic, the book itself was transformational in my understanding of wealth.

The way Kiyosaki explains it, an asset is anything that puts money in your pocket.

In the opposite respect, a liability is anything that takes money out of your pocket.

Through this definition, your mortgage is absolutely a liability, because it takes money out of your pocket every month. The same is true for your car payment, your credit cards, your office equipment, and your office.

You can not create true wealth through creating a portfolio of liabilities. And although this statement seems self explanatory, most people behave in a way that suggests the contrary.

Most people take out large amounts of debt to buy things that society has taught them are assets, which in fact they are liabilities. Most people go into debt to buy something that costs them money every month.

It’s completely backwards. You’re borrowing money to lose more money.

How To Stack Assets

For the record, I’m not against debt. In fact, borrowing money is often times very necessary in order to get the capital to buy assets. Borrowing can be a very useful tool, but you need to clearly see the difference between assets and liabilities so your not continuing to bury yourself.

If you are going to borrow money, you absolutely need to spend it on buying assets.

What are some examples of investments that put money into your pocket?

A rental property (here’s a breakdown of how Jules and I are turning our current home into our next rental property)

Equity in a company (this is why I spend so much time building my portfolio)

Stocks (Don’t be intimidated by stocks. The S&P 500 and other ETFS are low cost and have a very high probability of generating a return). ALSO THIS STATEMENT IS NOT INVESTMENTS ADVICE I HAVE NO IDEA WHAT I’M SAYING MAKE YOUR OWN CHOICES AND DON’T BLAME ME WHEN YOU LOSE MONEY BY GOING ALL IN ON A YOLO STOCK ON ROBIN HOOD. K? THANKS.

Ownership in a fund

This Is How You Generate Wealth

The reason that asset allocation works is because you exchange your money (or rather your cash) for a mechanism in which other people are putting in the hours that will create more cash for you in the future.

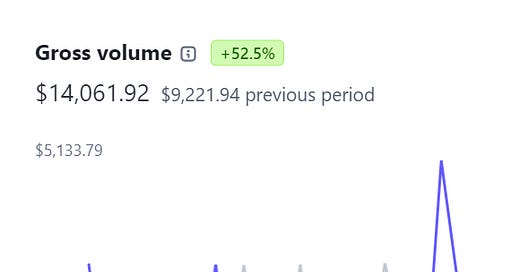

For instance, I own a rental property in Nashville.

Every week, my property manager sends me a statement of the rent she collects from our tenant. The statement also details any bills or repairs that needed to be paid for. In addition, the statement itemizes her fees for managing the property and then shows the profits that were generated.

I spend almost no time on managing this asset, yet someone else is putting in the hours to generate cash for me. In exchange for my investment, I make an easy $700 in profit a month, and someone else is paying the mortgage for me which means I’m building equity in the property and the property will probably increase in value.

Real estate is an easy example, but the concept also applies to companies.

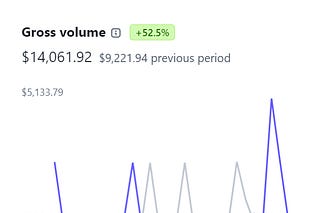

For instance, the team working on one of my investments works their butts off every day. Each month, I get a statement of dividends. Although the dividends are low (as the company is in growth mode) it’s still money that I earn through other people’s labor.

Rince and repeat.

Stop Working And Start Owning

I plan to write more about this concept in the future.

It’s nuanced because you absolutely need to work hard. In the beginning of your entrepreneurial journey, you have to create the system to generate the cash. For me, Stodzy Internet Marketing has always been the business that generates the cash for me to reinvest.

This company takes a lot of hard work and the team and I have put in countless hours. Your investment capital needs to come from somewhere, so I would fully expect to work your butt off for at least 10 years until you start generating the profits needed for investment capital to buy assets.

But with that money, you’re turning your hard work into other people’s hard work. Before long, you will have an army of people working for you and you have literally scaled your hard work.

As you’re able, you want to start exchanging your cash for assets. In order to do this, it’s important you know what an asset truly is.

Your future self will thank you.

Want To Work With Me? Here Are 3 Ways I Can Help You

1. Learn how to create multiple streams of income: You’ll get V.I.P. access to my business, research, and analysis. My membership will teach you how to create multiple streams of income. (Price goes up on 9/1)

2. Join my coaching program: I’ll help you grow your business by helping you define your target customer, create compelling products and services, generate more sales, and create systems that do the hard work for you. For serious entrepreneurs only.

3. Want me to do your marketing for you? Fill out this form to see if you’re a good fit for my high level SEO / advertising service. Minimum cost is $5000 a month.

Great point. Maybe a silly question, but where do you find companies to buy equity from?