Why I’m No Longer Investing In Digital Businesses

I’ve been thinking about this a lot, and I’ve decided to stop investing in digital businesses. At least for now.

My life is undergoing serious changes.

This week, I will share with you my thoughts on the future, and where I plan to allocate my money going forward.

LFG.

Why I Love Investing In Digital Businesses

Digital business models are unique because they have such incredible scale.

This means that they have a very low cost of product replication.

For instance, if I own a pizza store, then for every pizza I sell, it means I must make a pizza. The marginal cost of creating a new product is very high. I can only make as many dollars as pizzas I can make.

However, for digital first businesses, the marginal cost of replication is very low. In some cases, it’s zero.

For instance, when I sell a new membership to Copyblogger Academy, it’s almost all profit. Once I have created the product, I have covered my marginal cost. It costs me the same amount to serve one customer as it does to serve 10,000 customers.

Once my expenses are covered, it’s all profit.

There are downsides to digital first businesses as well. There’s no such thing as a perfect business model. However, in my view, the cost benefit of building a digital first business is very high. The potential upside is unlike any other business model.

This is why I have dedicated my personal holdings company into investing almost entirely into digital first businesses. It’s been incredibly lucrative, and I have zero regrets.

The Reason For The Change

My investing hero is Warren Buffet. I’ve written many times about how I shaped my investing philosophy around what he teaches.

never lose money

invest in cashflow

invest in the long game

let compounding do the work for you

be fearful when others are greedy and greedy when others are fearful

It is the last point I have been thinking about.

I see a lot of overheating in the world of digital entrepreneurship. There is plenty of opportunity and I suspect the world of digital entrepreneurship will continue to grow and thrive. I’m not predicting any catastrophic collapse.

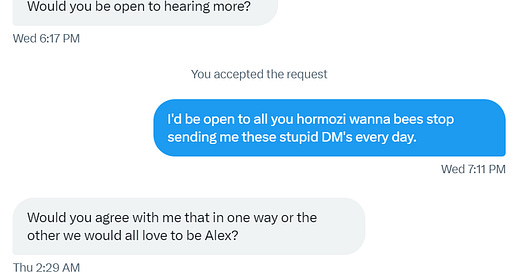

But I find it more and more difficult to see the difference between legit entrepreneurs and flashy Hormozi wanna-bees. I can tell by the massive influx of cold sales DMs I’ve received on Twitter in the last year.

(For the record, I’m not proud of this )

I see a lot of hype and greed in the world of digital entrepreneurship right now, and it makes me nervous.

In the opposite respect, I see a lot of fear and openings in other places.

Our digital first lifestyle has left people lonely, isolated, depressed, and looking for connection. Now, more than ever, people are looking for experiences and day to day activities that get them closer to other people, not further away from them.

This is especially true with millennials, who prefer spending money on experiences as opposed to physical possessions.

What’s more interesting, is that millennials are about to inherit a few TRILLION dollars from boomers. $$$

Everything I have read and all the data points I have been researching lead me to believe that the biggest opportunities are in businesses where people talk to each other and interact with each other face to face.

Okay Tim, So What Will You Be Investing In?

I see a lot of opportunities. Here is what’s going through my mind.

Real Estate: There continues to be a massive housing shortage in the United States. What’s more interesting is the available houses aren’t very attractive to millennials, who prefer open floor plans.

It’s likely that when the boomers pass on, millennials will knock down their houses and rebuild them with more open floor plans. As such, Jules and I have decided to buy our house in Denver. We will do the same thing we did with our house in Nashville, which is to invest in the home and eventually turn it into a rental property when we move again in 4 or 5 years.

Rise and repeat.

Spiritual Retreats: Most of you know that I am active in the behavioral healthcare space. One of the emerging trends in my space is the popularity of plant medicine retreats.

Although I do not intend to participate in plant medicine personally, many of my friends have done it and almost all of them consider it a life altering experience with huge positive benefits when it comes to dealing with past trauma. I am working on a few things in this space and will absolutely keep you posted.

Events And Conferences: Events and conferences will continue to boom. I am already seeing it in my space. Currently, my team is at the VALUE conference and it’s a hit. Millennials thrive in this sort of environment because we were raised to be social.

The entire reason we created The Census was so we could eventually build it up to the point where we could host in person networking events, conferences, and more.

P.S. – Shout out to Tricia and Erin who are currently killin’ the game in Miami.

In Person Healthcare Clinics Such As Ketamine Treatment, TMS Treatment, And Testosterone Replacement Therapy: These markets are booming. People are flocking to more localized healthcare. Testosterone treatment is on the rise, ketamine treatment is on the rise, and TMS treatment is on the rise.

I am very excited about the trend back to small healthcare.

Southeast Asia: I wrote about this in a recent issue. The projected growth for southeast Asia is staggering. My team in the Philippines is already sending me real estate opportunities. I’m taking this one slow, because I have a lot to learn about international business.

The United States: Say what you want about our completely incompetent congress, but the U.S. economy is on fire and there’s no reason to think it will slow down any time soon. I am going to be taking a good chunk of the money that I will be saving now that I am not investing into other companies, and dollar cost averaging into the S&P 500, ETFs, and maybe a few stocks that interest me. I already to this, but I will be increasing the dollar amount invested each week.

This is a generalization, but if your main investing thesis has been simply to “bet on America”, you would have become very rich. I see no evidence of that changing any time soon.

Below is my actual growth chart.

In Conclusion

When I was 24, I read a meme that said “grind in your 20’s, build in your 30’s and chill in your 40’s.” I’ve been griding and I have been building.

I still have work to do. I am by no means ready to lounge on a beach and retire. Not even close. But I am at a point where I need to start thinking about what the next stages are in my life and business.

My immediate plan is to do nothing. I’m not making any investments, I’m not writing any checks, and I’m not booking any deals.

I am head down on building my sales team. That’s my 100% focus.

However, I want to diversify. I want to spread my money into different asset classes and I want to do it slowly and smart.

I’m ready to slow down. I’m ready to let compounding do the heavy lifting.

This is the next chapter in my business and investing life. I’m nervous and excited.

The post Why I’m No Longer Investing In Digital Businesses appeared first on Tim Stoddart.